IMPORTANT REVASSURANCE UPDATE

ADVISORY NOTICE

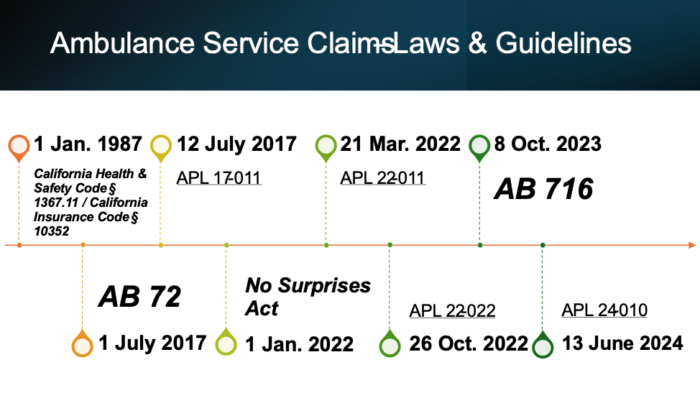

Historical Roadmap & Navigating Ambulance Provider Laws

On October 10, 2023, Assembly Bill (AB) 716 (Stats. 2023, Ch. 454) was enacted. This bill drastically changed the landscape of ambulance service claims by adding enrollee protections against balance billing for noncontracted ground ambulance services and creating a bona fide reimbursement methodology for select counties. California Health & Safety Code § 1371.56, one of the laws added by AB 716, requires ambulance services to be directly reimbursed for the difference between the in-network cost-sharing amount and the rate established or approved by the governing body of the local government having jurisdiction for that area or subarea. Accordingly, the legal rates established by the City of Los Angeles in LA City Ordinance (#185210) are now binding upon health plans. As such, the following letters: (1) CA HMO Affidavit – LA City Ambulance Transport No Contract Underpayment, and (2) CA HMO Appeal – LA City Ambulance Transport No Contract Underpayment have been updated on RevAssurance to reflect these changes.

Issues concerning contracted ambulance provider claims being denied for lack of authorization after the capitated provider requests pick-up have also been recently brought to our attention. To help you fight these denials, we have updated RevAssurance to include a sample appeal letter (CA HMO Appeal – Ambulance Transport Contract No Auth Improper Notice) as well as:

(1) [Fax Cover] Request for Authorization

(2) [Fax Cover] Request for Reconsideration

Dear Ambulance Provider Members,

We now provide you with (1) the historical roadmap of California laws and guidelines regarding ambulance service claims, and (2) guidance on how to navigate AB 716 and the DMHC’s recently released All Points Letter (APL) 24-010, which provides clarification on AB 716. We hope that the following information will be of use to your organization.

Historical Roadmap:

California Health & Safety Code § 1367.11

[January 1, 1987]

(a) Every health care service plan issued, amended, or renewed on or after January 1, 1987, that offers coverage for medical transportation services, shall contain a provision providing for direct reimbursement to any provider of covered medical transportation services if the provider has not received payment for those services from any other source.

(b) Subdivision (a) shall not apply to any transaction between a provider of medical transportation services and a health care service plan if the parties have entered into a contract providing for direct payment.

(c) For purposes of this subdivision, “direct reimbursement” means the following: The enrollee shall file a claim for the medical transportation service with the plan; the plan shall pay the medical transportation provider directly; and the medical transportation provider shall not demand payment from the enrollee until having received payment from the plan, at which time the medical transportation provider may demand payment from the enrollee for any unpaid portion of the provider’s fee.

California Insurance Code § 10352

[January 1, 1987]

(a) Every policy of disability insurance issued, amended, or renewed on and after January 1, 1987, that offers coverage for medical transportation services, shall contain a provision providing for direct reimbursement to any provider of covered medical transportation services if the provider has not received payment for those services from any other source.

(b) Subdivision (a) shall not apply to any transaction between a provider of medical transportation services and the insurer under a disability insurance policy if the parties have entered into a contract providing for direct payment.

(c) For purposes of this subdivision, “direct reimbursement” means the following: The insured shall file a claim for the medical transportation service with the insurer; the insurer shall pay the medical transportation provider directly; and the medical transportation provider shall not demand payment from the insured until having received payment from the insurer, at which time the medical transportation provider may demand payment from the insured for any unpaid portion of the provider’s fee.

Summary: These statutes required health plans to directly reimburse ambulance providers. Once the ambulance provider has received payment, the provider may balance bill the enrollee.

** NOTE: These laws were partially implicitly repealed on July 1, 2017 with the enactment of AB 72 and explicitly repealed effective January 1, 2024 with the enactment of AB 716.

AB 72 (Stats. 2016, Ch. 492)

[July 1, 2017]

The pertinent parts are as follows:

SECTION 1. Section 1371.30 is added to the Health and Safety Code, immediately following Section 1371.3, to read:

(a)(1) By September 1, 2017, the department shall establish an independent dispute resolution process for the purpose of processing and resolving a claim dispute between a health care service plan and a noncontracting individual health professional for services subject to subdivision (a) of Section 1371.9.

SEC. 2. Section 1371.31 is added to the Health and Safety Code, to read:

(a)(1) For services rendered subject to Section 1371.9, effective July 1, 2017, unless otherwise agreed to by the noncontracting individual health professional and the plan, the plan shall reimburse the greater of the average contracted rate or 125 percent of the amount Medicare reimburses on a fee-for-service basis for the same or similar services in the general geographic region in which the services were rendered. For the purposes of this section, average contracted rate means the average of the contracted commercial rates paid by the health plan or delegated entity for the same or similar services in the geographic region.

(4) A health care service plan shall include in its reports submitted to the department pursuant to Section 1367.035 and regulations adopted pursuant to that section, in a manner specified by the department, the number of payments made to noncontracting individual health professionals for services at a contracting health facility and subject to Section 1371.9, as well as other data sufficient to determine the proportion of noncontracting individual health professionals to contracting individual health professionals at contracting health facilities, as defined in subdivision (f) of Section 1371.9. The department shall include a summary of this information in its January 1, 2019, report required pursuant to subdivision (k) of Section 1371.30 and its findings regarding the impact of the act that added this section on health care service plan contracting and network adequacy.

(5) A health care service plan that provides services subject to Section 1371.9 shall meet the network adequacy requirements set forth in this chapter, including, but not limited to, subdivisions (d) and(e) of Section 1367 of this code and in Exhibits (H) and (I) of subdivision (d) of Section 1300.51 of, and Sections 1300.67.2 and 1300.67.2.1 of, Title 28 of the California Code of Regulations, including, but not limited to, inpatient hospital services and specialist physician services, and if necessary, the department may adopt additional regulations related to those services. This section shall not be construed to limit the director’s authority under this chapter.

(8) A noncontracting individual health professional, health care service plan, or health care service plans delegated entity who disputes the claim reimbursement under this section shall utilize the independent dispute resolution process described in Section 1371.30.

(d)(1) A payment made by the health care service plan to the noncontracting health care professional for nonemergency services as required by Section 1371.9 and this section, in addition to the applicable cost sharing owed by the enrollee, shall constitute payment in full for nonemergency services rendered unless either party uses the independent dispute resolution process or other lawful means pursuant to Section 1371.30.

SEC. 3. Section 1371.9 is added to the Health and Safety Code, to read:

(a)(1) Except as provided in subdivision (c), a health care service plan contract issued, amended, or renewed on or after July 1, 2017, shall provide that if an enrollee receives covered services from a contracting health facility at which, or as a result of which, the enrollee receives services provided by a noncontracting individual health professional, the enrollee shall pay no more than the same cost sharing that the enrollee would pay for the same covered services received from a contracting individual health professional. This amount shall be referred to as the in-network cost-sharing amount.

(3) A noncontracting individual health professional shall not bill or collect any amount from the enrollee for services subject to this section except for the in-network cost-sharing amount.

(f) For purposes of this section and Sections 1371.30 and 1371.31, the following definitions shall apply:

(1) Contracting health facility means a health facility that is contracted with the enrollees health care service plan to provide services under the enrollees plan contract. A contracting health care facility includes, but is not limited to, the following providers:

(A) A licensed hospital.

(B) An ambulatory surgery or other outpatient setting, as described in subdivision (a), (d), (e), (g), or (h) of Section 1248.1.

(C) A laboratory.

(D) A radiology or imaging center.

(3) Individual health professional means a physician and surgeon or other professional who is licensed by this state to deliver or furnish health care services.

Analogous sections were added to the Insurance Code under Sections 10112.8, 10112.81, and 10112.82 to cover plans (primarily PPO) regulated by the California Department of Insurance.

Summary: This California bill prohibited non-contracted providers from “surprise balance billing” an enrollee who received covered services from an in-network health facility for non-emergency services. Furthermore, this bill created a non-binding Independent Dispute Resolution Process (“IDRP”) process through the DMHC specifically for non-contracted providers who provided non-emergency services at an in-network facility and limited the reimbursement rate for non-contracted providers who provided such services to the greater of the average contracted rate or 125% of the amount Medicare reimburses on a fee-for-service basis for the same or similar services in the general geographic region where the services were rendered.

Under AB 72 [California Health & Safety Code § 1371.9(f)(1)(B)], which references California Health & Safety Code § 1248.1(h), all ambulance providers are considered health facilities. Thus, Ambulance providers are prohibited from balance billing under AB 72, per California Health & Safety Code § 1248.1(h):

(h) A setting, including, but not limited to, a mobile van, in which equipment is used to treat patients admitted to a facility described in subdivision (a), (d), or (e), and in which the procedures performed are staffed by the medical staff of, or other healthcare practitioners with clinical privileges at, the facility and are subject to the peer review process of the facility but which setting is not a part of a facility described in subdivision (a), (d), or (e).

Implicit vs. Explicit Repeal

** While California Health & Safety Code § 1367.11 was not repealed as a result of AB 72’s passage, the provisions conflicted with regards to non-contracted providers’ services at an in-network health facility. Thus, the legal doctrine of implicit repeal is potentially invoked here, albeit not wholesale. This doctrine is based on the Latin phrase: “leges posteriores priores contrarias abrogant” or “lex posterior derogat priori.” The California Supreme Court explained in Penziner v. West American Finance Co. that “[t]he presumption is against repeals by implication, especially where the prior act has been generally understood and acted upon.” (Penziner v. West American Finance Co., 10 Cal.2d 160). Implicit repeal can only occur when “the two acts [are] irreconcilable, clearly repugnant, and so inconsistent that the two cannot have concurrent operation.” (Id.) California Health & Safety Code § 1367.11 allows balance billing. To be explicit, there are two scenarios where balance billing occurs: (1) non-contracted provider provides services at an in-network health facility, and (2) non-contracted provider provides services at an out-of-network health facility. In each of these scenarios, the services provided can be emergency or non-emergency. To be clear, California case law and the Knox-Keene Act already prohibited non-contracted providers from balance billing enrollees for out-of-network emergency services. (See Prospect v. Northridge, 45 Cal. 4th 497 (2009); see also 28 CCR §§ 1300.71(s)(4) and 1300.71.39). AB 72 created an anti-balance billing prohibition only for circumstances involving non-contracted providers’ non-emergency services at an in-network health facility.

A reasonable interpretation of these laws, then, is that non-contracted providers were permitted to balance bill (1) if the enrollee had a plan with coverage for out of network benefits, and the criteria for prior consent was met under 1371.9 (c), (2) when they provided non-emergency services at an out-of-network health facility, and (3) when they provided emergency services at an in-network health facility. Thus, California Health & Safety Code § 1367.11 could be construed to have been partially implicitly repealed.

APL 17-011

[July 12, 2017]

The DMHC summarized AB 72 for health plans.

No Surprises Act

[January 1, 2022]

Summary: Part of the omnibus appropriations bill titled Consolidated Appropriations Act of 2021, the No Surprises Act, prohibited surprise balance billing enrollees. The No Surprises Act makes specific reference and applies to emergency, non-emergency, and air ambulance service providers. However, ground ambulance service providers were left out of the No Surprises Act and are not prohibited from balance billing patients.

APL 22-011

[March 21, 2022]

The DMHC clarified that state anti-balance billing laws are not preempted by the No Suprises Act if they meet certain requirements. The DMHC indicated that AB 72 was an anti-balance billing law that met these requirements. Accordingly, AB 72 would control and is not preempted by the newly enacted federal anti-balance billing law which permits ground ambulance providers to balance bill.

The DMHC then specifically referenced the definitions of in-network facilities (i.e., hospitals, ambulatory surgery centers, laboratories, radiology or imaging centers, other outpatient settings defined in Health and Safety Code section 1248.1, subdivisions (a), (d), (e), (g) and (h)) and noted that they are broader than those found in the No Suprises Act. California Health & Safety Code § 1248.1(h), as stated above, refers to ambulance providers. Therefore, non-contracted ground ambulance providers cannot balance bill pursuant to AB 72 where non-emergency services were provided at an in-network health facility.

In addition, if there was a disagreement between a health plan and non-contracted ground ambulance provider regarding the appropriate reimbursement amount when non-emergency services were provided at an in-network facility, the DMHC’s IDRP process must be used.

In the instance of air ambulance, however, California does not have a specified state law for reimbursement rates or an established IDRP process. As such, air ambulance providers are beholden to the No Suprises Act provisions for reimbursement.

APL 22-022

[October 26, 2022]

In part, due to ERN’s complaint filings, the DMHC released this APL. The DMHC emphasized and reminded health plans that AB 72 disallowed non-contracted ambulance service providers from balance billing patients when non-emergency services were rendered at an in-network facility.

Moreover, the DMHC reminded the health plans of their obligations to have an adequate network of ambulance providers. The DMHC stated:

The DMHC reminds plans that they must maintain an adequate network of providers to perform covered services, including ground ambulance/medical transportation (see Rule 1300.51, Exhibit I-3). In the case of non-emergency ground ambulance/medical transportation, the pattern of complaints filed with the DMHC indicates contracted health facilities routinely arrange for services from non-contracted ground ambulance/medical transportation providers. Health plans should take steps to ensure contracted health facilities are making in-network referrals and enrollees are protected from balance billing when an enrollee receives non-contracted services and when AB 72 is applicable. (APL 22-022)

28 CCR 1300.51(I) (Exhibits I-3, I-4, and I-5), as shown below, describes the health plan’s network adequacy obligation:

3. All Other Providers of Health Care Services. Attach as Exhibit I-3 a list of all providers of health care service contracting with or owned by the applicant which are not included in the physician and hospital listings. For each such provider, furnish the following information:

a. The legal name of the provider and any “dba.”

b. Its address.

c. Its license number.

d. The health care services it provides to enrollees of the plan (e.g., home health agencies, ambulance company, laboratory, pharmacy, skilled nursing facility, surgi-center, mental health, family planning, etc.).

e. Its hours of operation and the provision made for after-hours service.

f. An appropriate measure of the provider’s capacity to provide health care service, the existing utilization of such services by other than enrollees of the plan and the projected use of the services by enrollees.

g. The provider’s relationship to the plan (owned by, contracting with, etc.).

4. Calculation of Provider-Enrollee Ratios. As Exhibit I-4, furnish a calculation of the adequacy of the applicant’s provider arrangements for each region or provider network within applicant’s service area. This should be based on the full range of the health care services covered by the applicant’s full-service or specialized plan contracts, the extent to which contracting and planned-owned or employed providers are available to provide such services, the enrollee population served by such providers and the adequacy of the provider system in each category based on standard utilization data. Assumptions employed in such calculations should be stated, including the extent to which paraprofessionals and allied health personnel will be used by applicant or providers and the protocols and method of supervision of such personnel.

5. Applicant’s Standards of Accessibility. Attach as Exhibit I-5 a detailed description of the applicant’s standards with respect to the accessibility and its procedures for monitoring the accessibility of services. Standards should be expressed in terms of the level of accessibility which the applicant has as its objective and the minimum level of accessibility below which corrective action will be taken. Cover each of the following:

a. the availability of appointments for primary care and specialty services,

b. the availability of after hours and emergency services,

c. an assessment of probable patient waiting times for scheduled appointments,

d. the proximity of specialists, hospitals, etc. to sources of primary care, and

e. a description of applicant’s system for monitoring and evaluating accessibility. (Discuss applicant’s system for monitoring problems that develop, including telephone inaccessibility, delayed appointment dates, waiting time for appointments, other barriers to accessibility, and any problems or dissatisfaction identified through complaints from contracting providers or grievances from subscribers or enrollees.)

f. the contractual arrangements utilized by the applicant to assure the monitoring of accessibility and conformance to standards of accessibility by contracting providers.

The DMHC was non-specific in the statements surrounding health plans’ ambulance network adequacy obligations. As such, it is unclear whether health plans were not complying with the network adequacy obligations and/or what steps health plans should take exactly to ensure that contracted health facilities are only arranging for ambulance services from contracted ambulance providers. In light of AB 716, however, ERN believes that revisiting this issue is not warranted due to the prohibition of balance billing by non-contracted ground ambulance providers.

As long as health plans have met their network adequacy obligations, they are not legally obligated in any way to engage with other ambulance providers for contract negotiations. Nonetheless, ERN is acutely aware of health plans’ tactics to enter into unfavorable contracts with ambulance providers. ERN is currently exploring various avenues, whether legislative/regulatory lobbying, partnerships, or direct representation, to ensure that ambulance providers are not unduly burdened or being taken advantage of in contract negotiations.

AB 716 (Stats. 2023, Ch. 454)

[October 8, 2023]

The pertinent parts are as follows:

SECTION 1. Section 1367.11 of the Health and Safety Code is repealed.

SEC. 2. Section 1371.56 is added to the Health and Safety Code, to read:

(a)(1) Unless otherwise required by this chapter, a health care service plan contract issued, amended, or renewed on or after January 1, 2024, shall require an enrollee who receives covered services from a noncontracting ground ambulance provider to pay no more than the same cost-sharing amount that the enrollee would pay for the same covered services received from a contracting ground ambulance provider. This amount shall be referred to as the in-network cost-sharing amount.

(2) An enrollee shall not owe the noncontracting ground ambulance provider more than the in-network cost-sharing amount for services subject to this section. At the time of payment by the plan to the noncontracting provider, the plan shall inform the enrollee and the noncontracting provider of the in-network cost-sharing amount owed by the enrollee and shall disclose whether or not the enrollees coverage is regulated by the department or if the coverage is not state-regulated.

(d)(1) Unless otherwise agreed to by the noncontracting ground ambulance provider and the health care service plan, the plan shall directly reimburse a noncontracting ground ambulance provider for ground ambulance services the difference between the in-network cost-sharing amount and an amount described, as follows:

(A) If there is a rate established or approved by a local government, at the rate established or approved by the governing body of the local government having jurisdiction for that area or subarea, including an exclusive operating area pursuant to Section 1797.85.

(B) If the local government having jurisdiction where the service was provided does not have an established or approved rate for that service, the amount established by Section 1300.71 (a)(3)(B) of Title 28 of the California Code of Regulations.

(2) A local government has jurisdiction over the ground ambulance transport if either of the following applies:

(A) The ground ambulance transport is initiated within the boundaries of the local governments regulatory jurisdiction.

(B) In the case of ground ambulance transports provided on a mutual or automatic aid basis into another jurisdiction, the local government where the noncontracting ground ambulance provider is based.

(3) A payment made by the health care service plan to the noncontracting ground ambulance provider for services as required in subdivision (a), plus the applicable cost sharing owed by the enrollee, shall constitute payment in full for services rendered.

(4) Notwithstanding any other law, the amounts paid by a health care service plan for services under this section shall not constitute the prevailing or customary charges, the usual fees to the general public, or other charges for other payers for an individual ground ambulance provider.

SEC. 3. Section 1797.124 is added to the Health and Safety Code, to read:

(a) On or before March 1, 2024, and on or before each January 1 thereafter, the authority shall annually develop and publish on its internet website a report showing the allowable maximum rates for ground ambulance transportation services in each county, including trending the rates by county. If feasible, this report shall include the applicable Medicare rate for the year.

SEC. 4. Section 1797.233 is added to the Health and Safety Code, to read:

(a) A ground ambulance provider shall not require an uninsured patient or self-pay patient to pay an amount more than the established payment by Medi-Cal or Medicare fee-for-service amount, whichever is greater.

(b)(1) A ground ambulance provider shall only advance to collections the Medicare or Medi-Cal payment amount, as determined pursuant to subdivision (a), that the uninsured or self-pay patient failed to pay.

SEC. 5. Section 10126.66 is added to the Insurance Code, to read:

(a)(1) Unless otherwise required by this chapter, a health insurance policy issued, amended, or renewed on or after January 1, 2024, shall require an insured who receives covered services from a noncontracting ground ambulance provider to pay no more than the same cost-sharing amount that the insured would pay for the same covered services received from a contracting ground ambulance provider. This amount shall be referred to as the in-network cost-sharing amount.

(2) An insured shall not owe the noncontracting ground ambulance provider more than the in-network cost-sharing amount for services subject to this section. At the time of payment by the insurer to the noncontracting provider, the insurer shall inform the insured and the noncontracting provider of the in-network cost-sharing amount owed by the insured and shall disclose whether or not the insureds coverage is regulated by the department or if the coverage is not state-regulated.

(d)(1) Unless otherwise agreed to by the noncontracting ground ambulance provider and the health insurer, the insurer shall directly reimburse a noncontracting ground ambulance provider for ground ambulance services the difference between the in-network cost-sharing amount and an amount described, as follows:

(A) If there is a rate established or approved by a local government, at the rate established or approved by the governing body of the local government having jurisdiction for that area or subarea, including an exclusive operating area pursuant to Section 1797.85 of the Health and Safety Code.

(B) If the local government having jurisdiction where the service was provided does not have an established or approved rate for that service, the reasonable and customary value for the services rendered, based upon statistically credible information that is updated at least annually and takes into consideration all of the following:

(i) The ambulance providers training, qualifications, and length of time in practice.

(ii) The nature of the services provided.

(iii) The fees usually charged by the ambulance provider.

(iv) Prevailing ground ambulance provider rates charged in the general geographic areas in which the services were rendered.

(v) Other aspects of the economics of the ambulance providers practice that are relevant.

(vi) Any unusual circumstances in the case.

(2) A local government has jurisdiction over the ground ambulance transport if either of the following applies:

(A) The ground ambulance transport is initiated within the boundaries of the local governments regulatory jurisdiction.

(B) In the case of ground ambulance transports provided on a mutual or automatic aid basis into another jurisdiction, the local government where the noncontracting ground ambulance provider is based.

(3) A payment made by the health insurer to the noncontracting ground ambulance provider for services as required in subdivision (a), plus the applicable cost sharing owed by the insured, shall constitute payment in full for services rendered.

(4) Notwithstanding any other law, the amounts paid by a health insurer for services under this section shall not constitute the prevailing or customary charges, the usual fees to the general public, or other charges for other payers for an individual ground ambulance provider.

SEC. 6. Section 10352 of the Insurance Code is repealed.

Summary: This California bill explicitly repealed the old California statutes permitting balance billing for ambulance providers and clearly delineates obligations for non-contracted ground ambulance providers and health plans. The following provisions were proclaimed:

- Ambulance providers may only bill insured patients the in-network cost-sharing amount. If the patient is not insured or the insurance does not cover NEMT services, you may bill the patient the greater of Medi-Cal or Medicare rates.[1]

- Health plans must directly reimburse non-contracted ground ambulance providers.

- Health plans must pay the difference between the in-network cost-sharing amount and a rate established by local governments. If there is no established rate, health plans must pay the reasonable and customary value for the services rendered.[2]

- The rate established by local governments is triggered when: A) The non-emergency medical transportation (NEMT) is initiated within the local government’s regulatory jurisdiction or B) The NEMT provider provides Mutual or Automatic Aid, in which case, the rate is established in the local government where the noncontracting ground ambulance provider is based.

- Upon payment by a health plan, the plan must inform the non-contracted ambulance provider of the enrollee’s in-network cost-sharing amount and governing regulatory jurisdiction.

- The California Emergency Medical Services Authority (EMSA) must develop and publish a report showing the allowable maximum rates for ground ambulance transportation services in each county, including trending the rates by county.

- The California EMSA has informed ERN that it will be meeting with partners in the upcoming weeks to begin development of the AB 716 report requirements.

- ERN will keep you updated as soon as we receive the latest information regarding this publication.

In general, mutual aid is the concept of resource sharing in which similar organizations assist each other during emergencies and day-to-day operations. For the purposes of this document, mutual aid will encompass the following:

Auto/Instant Aid

Agreements between two or more jurisdictions where the nearest available resource is dispatched to an emergency irrespective of jurisdictional boundaries or where two or more agencies are automatically dispatched simultaneously to predetermined types of emergencies. This type of mutual aid agreement is typically utilized on a day-to-day basis.

Mutual Aid

Agreements between two or more jurisdictions to provide assistance across jurisdictional boundaries, when requested, as a result of the circumstances of an emergency exceeding local resources.

Disaster Assistance

Similar to mutual aid but are requests for assistance in the event that a disaster overwhelms local resources. These requests may be under existing mutual aid agreements or the result of unforeseen needs arising from a particularly large-scale disaster.

Note : Even if a service was provided in 2024, AB 716 would not apply if the patient had a plan that was issued in 2023 and not yet renewed until after the date of service. However, ERN’s position to all ambulance providers is to avoid these technicalities and cease the practice of balance billing immediately, to steer clear of any potential or actual legal violations.

APL 24-010

[June 13, 2024]

The DMHC summarized AB 716 for health plans.

Roadmap: Navigating Ambulance Service Claims in 2024 and Beyond

Ambulance providers are prohibited from balance billing the vast majority of insured patients.

Air ambulance service providers: The federal No Surprises Act prohibits you from balance billing, and controls the reimbursement rates and procedures.

Ground ambulance service providers: California AB 716 prohibits you from balance billing most insured patients, and controls the reimbursement rates and procedures. Moving forward, the rates will likely differ based on the local jurisdiction in which you are providing the service. At this time, the California Emergency Medical Services Authority has not published a report for the rates by county. As a result, it may be difficult for you to ascertain the correct reimbursement amount for each claim.

California — Directed Action Plan for Disputing Claim Denials/Underpayments

- Determine governing regulatory agency and jurisdiction of the enrollee’s health plan

- A plan’s EOB, pursuant to California Health and Safety Code §§ 1371.56(a)(2), should include this information.

- For fully-insured health plans within the State of California, there are three regulatory agencies.

- The DMHC governs HMOs, Blue Cross PPO, and Blue Shield PPO.

- The DMHC and Department of Health Care Services govern Medi-Cal.

- The Department of Insurance governs PPOs, and Blue Cross Life & Health.

- For employer/group health plans, there are two federal regulatory agencies.

- The U.S. Department of Labor, Employee Benefits Security Administration governs private-employer self-insured plans.

- The U.S. Department of Health and Human Services, Centers for Medicare and Medicaid Services (Center for Consumer Information & Insurance Oversight) governs non-federal government self-insured plans.

- For federal employee health plans, there is one regulatory agency.

- The U.S. Office of Personnel Management governs federal employee health plans (even if coverage is provided through a private insurer).

- Determine the appropriate reimbursement rates

- Check for applicable rates set by a county or local government

- If there are no applicable rates, EMSA recommends that you reach out to the Local EMS Agencies (LEMSAs) until the reference rates for all counties are published.

- Exhaust Dispute Resolution process with health plan

- For claims involving nonemergency transport services, you can contest improper denials using AB 716’s reimbursement and notification laws (codified in California Health and Safety Code §§ 1371.56(a)(2), 1371.56(d))

- Per California Health and Safety Code § 1371.56(a)(2), health plans must inform you, upon issuing a payment, of the in-network cost-sharing amount owed by the enrollee and the governing regulatory agency/jurisdiction.

- Per California Health and Safety Code § 1371.56(d), health plans must pay the local or county reimbursement rates, if published. If not, health plans must pay the reasonable and customary amount.

- Be aware of health plans underpaying a claim, citing reasonable/usual/customary amounts, when a local or county rate exists and applies.

- Escalate the legal violations to the employer’s plan administrator (fiduciary), where applicable

- File a complaint with the appropriate governing regulatory agency

- Please note that you may only file a complaint with the U.S. Office of Personnel Management and U.S. Department of Labor, Employee Benefits Security Administration as an authorized representative of the enrollee (and will need the patient’s signature on an authorized representative form).

FILING A COMPLAINT WITH THE DMHC

The DMHC has confirmed that all violations of reimbursement (government rate/UCR) and notice requirements under AB 716 should be filed with the DMHC’s Provider Complaint Unit (PCU). Please follow the DMHC’s instructions below:

http://www.dmhc.ca.gov/FileaComplaint/ProviderComplaintAgainstaPlan/SubmitaProviderComplaint.aspx

FILING A COMPLAINT WITH THE DEPARTMENT OF INSURANCE

The Department of Insurance has included a useful guide for providers here:

The portal to submit provider complaints can be found below:

https://cdiapps.insurance.ca.gov/HPP/login

FILING A DMHC AB 72 IDRP

** Please be advised that the DMHC AB 72 IDRP is only available to non-contracted providers who rendered non-emergency services at an in-network health facility between July 1, 2017 and January 1, 2024.

You can find the submission instructions and eligibility requirements here:

If you have any questions or issues regarding claims appeals or reimbursement, please contact ERN for consultation and/or regulatory representation. We have over 24 years of expertise and can assist you with navigating the next steps after your claim has been improperly denied.

Respectfully,

Thitipong Mongkolrattanothai, J.D., M.P.H.

Sr. Compliance Auditor I

ERN/TRAF – The Reimbursement Advocacy Firm

Tel: (714) 820-6967 Fax: (714) 995-6901

Email: thitipongmongkolrattanothai@ernenterprises.org

References:

[1] See California Health & Safety Code § 1797.233, which states: “A ground ambulance provider shall not require an uninsured patient or self-pay patient to pay an amount more than the established payment by Medi-Cal or Medicare fee-for-service amount, whichever is greater.”

[2] See Gould Factors, 28 CCR 1300.71(a)(3)(B), which considers: (i) The ambulance providers training, qualifications, and length of time in practice; (ii) The nature of the services provided; (iii) The fees usually charged by the ambulance provider; (iv) Prevailing ground ambulance provider rates charged in the general geographic areas in which the services were rendered; (v) Other aspects of the economics of the ambulance providers practice that are relevant; (vi) Any unusual circumstances in the case.

Categorised in: General

This post was written by RevAssurance